Language

- English

- Română

Currency

- $ USD

- € EUR

- lei RON

- ₹ INR

- AUD

The United States is focused on tokenized certificates of deposit | Opinion

More News Articles

Raoul Pal Says Crypto Market Nowhere Near COVID-19 'Peak Fear'

Macro investment strategist Raoul Pal believes the recent crypto market pullback is far from a cause for panic and could, in fact, be a rare entry point for Bitcoin (CRYPTO: BTC) investors. What Happened: Speaking in a podcast on April 7, Pal said investor sentiment hasn't yet reached the “peak fear” levels last seen during the COVID-19 crash, but it's getting close—and that's exactly when big opportunities arise.

Justin Sun Calls Out Seven Sins by First Digital Trust

Justin Sun said First Digital Trust has misappropriated over $500 million in TUSD reserves through unauthorized transfers and falsified records, and launched a $50 million bounty program to recover the funds and expose alleged fraud, laundering, and regulatory violations. The post Justin Sun Calls Out Seven Sins by First Digital Trust appeared first on Cryptonews.

EXCLUSIVE: MoonPay secures VASP registration in Jersey

MoonPay has secured registration as a Virtual Asset Service Provider in Jersey, the largest of the Channel Islands, further expanding its regulated global operations.

SBI Holdings Inc. Weighs Reducing Its Stake in B2C2 Crypto Unit

Japanese SBI Holdings plans to reduce its stake in the B2C2 crypto unit. The firm bought a minority stake in the B2C2 market maker in 2020.

Binance CEO Says Tariff Mayhem May Benefit Crypto

Richard Teng, chief executive officer at cryptocurrency exchange behemoth Binance, has predicted that the macrofinancial uncertainty caused by the tariff mayhem might end up benefiting the crypto market in the long term.

U.S.-China escalation ‘worst case scenario' for risk assets and crypto: Nansen

Crypto plummeted amid a tariffs-driven market turmoil this week, and analysts at Nansen believe further escalation between the United States and China represents the worst-case scenario.

Exclusive: Sequence sunsets Horizon Blockchain Games in rebrand

Crypto gaming infrastructure firm Sequence — which also owns Horizon Blockchain Games — is shutting down its Horizon brand.

Ukraine War Profiteers Get 13 Years for $7.3 Million Crypto Money Laundering

The two men were part of a gang that tried to exploit demand in Ukraine for vans and lorries as part of the war effort.

EU markets watchdog warns of crypto-related financial stability risks

The European Union's securities watchdog warned on Tuesday that problems in the cryptocurrency industry could pose risks to broader financial stability in future, as the sector grows and as ties between it and traditional financial markets increase.

Don't Buy the Dip! Here's Why

The Crypto Trader author Glen Goodman joins CoinDesk to discuss whether investors should buy the dip in crypto following the recent market crash. Plus, long-term outlook on bitcoin's price and the correlation between BTC and the stocks market.

Binance to purge 14 tokens following ‘vote to delist' process

Binance is planning to delist 14 tokens from its platform on April 16 in a move designed to purge low-quality projects that do not adhere to the crypto exchange's tighter listing requirements. The tokens are being delisted following a “comprehensive evaluation of multiple factors,” including the exchange's first “vote to delist” results, where community members nominated projects with less than stellar metrics, Binance announced on April 8.

Binance Smart Chain-based Venus Protocol votes to ‘reimburse' Venus Labs $1.7 million for work done in second half of 2024

Venus Labs requested $1.7 million paid in BTC, BNB, ETH and USDT for work it did in the last two quarters of 2025.

Trump Administration Shuts Down The Department Of Justice's Crypto Crime Unit

The U.S. Department of Justice has terminated its specialized cryptocurrency investigation team, signaling a significant shift in federal oversight of digital assets. What Happened: In a detailed internal memorandum, Deputy Attorney General Todd Blanche announced the immediate dissolution of the National Cryptocurrency Enforcement Team (NCET), aligning with President Donald Trump's directive to foster a more crypto-friendly regulatory environment.

Breaking NEWS: Trump Admin Shuts Down Crypto Crime Unit

The Justice Department says it will no longer target exchanges or wallets unless serious crimes are involved. What does this mean for crypto investors.

Trump administration retires DOJ's crypto enforcement task force

DOJ prosecutors will now cases that pose direct risks to investors.

Why Singapore Outpaces Hong Kong In Attracting Crypto Operators

Singapore has emerged as a beacon of stability and innovation. Over the past few years, the city-state has positioned itself as a global leader in digital assets and blockchain technology, attracting some of the biggest names in the industry.

Base and stablecoins set stage for Coinbase to become ‘mission-critical' crypto infrastructure, Cantor Fitzgerald says

Coinbase could see 5–10x stablecoin revenue growth by 2030, according to Cantor, which gave COIN a $245 target.

Binance Founder CZ Named Adviser To Pakistan Crypto Council

In a major win for Pakistan's cryptocurrency market, Changpeng Zhao (CZ), the co-founder and former CEO of Binance, the world's largest crypto exchange, has been appointed as a strategic adviser to the Pakistan Crypto Council (PCC).

DOJ ends crypto enforcement team, shifts focus to terrorism and fraud

The U.S. Justice Department closed the National Cryptocurrency Enforcement Team.

Coinshares Head of Asset Management Frank Spiteri Departs: Sources

Frank Spiteri, Head of Asset Management at CoinShares, has departed the company, according to sources familiar with the matter. The post Coinshares Head of Asset Management Frank Spiteri Departs: Sources appeared first on Cryptonews.

Binance Delists These Altcoins, Triggering a Price Meltdown: Details Here

Check out which cryptocurrencies Binance will drop from its platform on April 16.

DOJ Axes Crypto Unit as Trump's Regulatory Pullback Continues

“The Department of Justice is not a digital assets regulator,” U.S. Deputy Attorney General Todd Blanche said in the Monday night memo.

CoinShares Head of Asset Management Frank Spiteri Has Left the Company: Sources

Spiteri worked for the crypto asset manager in London for over five years.

Altcoin liquidity's dropped since President Trump's tariff announcement: Kaiko Research

So much for any hope around an altcoin resurgence.

State Regulators Push Back on Proposed Federal Control of Stablecoin Industry

Crypto's biggest success story, after a litany of industry failures, has been stablecoins. The asset-pegged digital tokens, designed to maintain their stability and facilitate non-volatile financial applications across blockchains, have to-date grown so much that there exist around $234 billion in circulation.

Lyzi raises €1.3 million in seed funding round

Lyzi, the French crypto payments platform, has successfully raised €1.3 million in seed funding, as per the reports shared with Finbold on Tuesday, April 8.

Coinbase More Than Just Trading Platform, Its 'Mission-Critical' for Crypto, Cantor Says

The broker initiated coverage of the crypto exchange with an overweight rating and a $245 price target.

Binance to Delist 14 Tokens After Community Vote

After a thorough review and community voting process, Binance will delist tokens. This includes BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, and VIDT.

Altcoin at the turning point: signs of recovery in the crypto market according to CoinEx Research

The monthly report from CoinEx Research outlines a dynamic picture of the crypto market in March 2025, amidst record inflows of stablecoins, macroeconomic tensions, new regulations, and rebound signals for altcoins. The month of March 2025 represented a phase of consolidation and uncertainty for the cryptocurrency market, but also of potential transformation.

Crypto Market Rebounds After ‘Black Monday' Crash

TL;DR Bitcoin (BTC) bounces back and surpasses $80,000 after a historic crash that wiped out $12,000 in less than a week. The crypto market adds over $120 billion in capitalization in just 24 hours, with altcoins like ADA and DOGE showing double-digit gains.

US DOJ disbands crypto enforcement team amid policy shift under Trump

The US Department of Justice (DOJ) has reportedly shut down the National Cryptocurrency Enforcement Team (NCET), its specialized division tasked with investigating crypto-related crimes. The move, confirmed through an internal memo cited by Fortune in an April 8 report, reflects a significant shift in federal oversight of the emerging industry.

U.S. DOJ Disbands Crypto Enforcement Team, Shifts Focus to Scammers Targeting Investors

The U.S. DOJ disbands its National Cryptocurrency Enforcement Team, shifting focus to prosecuting scammers targeting investors, aligning with Trump's executive order to clarify digital asset regulations and reduce enforcement-driven oversight. The post U.S. DOJ Disbands Crypto Enforcement Team, Shifts Focus to Scammers Targeting Investors appeared first on Cryptonews.

SBI Holdings denies report of $100m crypto unit B2C2 stake sale

SBI Holdings has refuted claims that it intends to sell a $100 million stake in its cryptocurrency trading subsidiary, B2C2.

U.S. Justice Department Ends Crypto Crime Unit Amid Regulatory Overhaul

TL;DR DOJ Shifts Focus: The U.S. Justice Department disbands its crypto crime unit, aligning with Trump's pro-crypto policies to foster innovation and reduce enforcement-driven oversight. Regulatory Overhaul: New directives prioritize prosecuting individual bad actors over targeting exchanges or wallets, signaling a strategic pivot in digital asset regulation.

Dubai gov't agencies to link real estate registry with property tokenization

Dubai's real estate and crypto regulatory authorities have signed a new agreement aimed at expanding digital asset adoption in the real estate sector.On April 6, the Dubai Land Department (DLD) announced an agreement with the Virtual Assets Regulatory Authority (VARA). According to the announcement, the agreement will link Dubai's real estate registry with property tokenization through a governance system.

French Bank Partners with Decentralized Exchange

Banque Delubac & Cie, a family owned French bank established in 1924, has partnered with a new decentralized exchange called DevvDigital.

US DOJ scraps crypto crime team under Trump's new policy era

The DOJ's shift away from crypto crime enforcement may foster a more innovation-friendly environment but raises investor protection concerns. The post US DOJ scraps crypto crime team under Trump's new policy era appeared first on Crypto Briefing.

USA: the unit against crypto crimes has been eliminated

Today Fortune revealed that the US Department of Justice disbanded the unit that dealt with crypto crimes. It was a task force of the DoJ (Department of Justice) that was specifically responsible for investigating crimes related to cryptocurrencies.

Circle's Head of Policy advocates for MiCA broadening crypto regulations

Circle's Head of Global Policy Dante Disparte believes the crypto space needs more regulatory clarity in the form of frameworks like Europe's MiCA.

Russians triple crypto investments in 3 years, buy more gold amid uncertainty

Russian citizens have sharply increased their investments in crypto assets and precious metals in the past three years, a study conducted by the Central Bank of Russia has shown. The findings come at a time of heightened uncertainty regarding market trends, particularly in the case of cryptocurrencies.

New Crypto to Explode as Trump Tariffs Drive Inflation

Trump's recent intensification of tariff policies and fears of even greater tariffs to come have ignited widespread concern among economists, investors, and policymakers. Unsurprisingly, markets have crashed.

Crypto Market Outlook April 2025: DCA Strategy May Pay Off

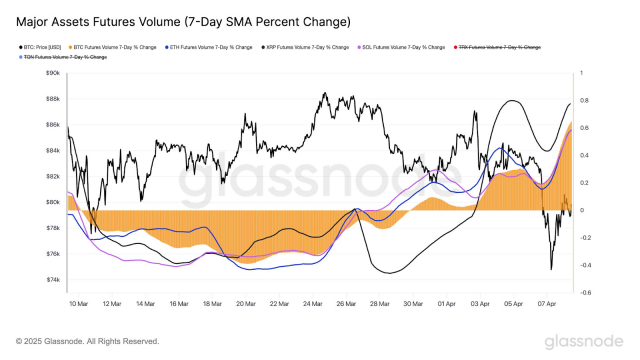

The wider crypto market has continued to showcase resilience after the Asian and European stock markets recorded bullish sentiment on Tuesday. Bitcoin (BTC) has attempted to regain crucial support levels above $80k in the past two days in vain, triggering a spike in crypto speculative trading, especially perpetual and futures contracts trading.

Binance Adds KERNEL to Megadrop Lineup as Restaking Craze Grows

TL;DR Megadrop Launch: Binance adds KernelDAO (KERNEL) to its Megadrop lineup, offering early access rewards from April 9 with an official listing on April 14 across five trading pairs. Innovative Restaking Protocol: KERNEL leverages a shared restaking mechanism on BNB Chain, enabling users to optimize yield from assets like BNB and BTC for additional rewards.

Trump administration reportedly shutters DOJ's crypto enforcement team

The United States Department of Justice (DOJ) is reportedly disbanding the National Cryptocurrency Enforcement Team (NCET).NCET's disbandment was noted in a four-page memo by United States Deputy General Todd Blanche, according to a Fortune journalist who claims to have seen the document in an April 8 report. The official is quoted saying in the note: “The Department of Justice is not a digital assets regulator.

Galaxy Digital Nasdaq Listing: Could It Boost VC Funding?

Galaxy Digital, the leading investment management firm of Michael Novogratz, has received SEC approval for its registration statement and plans to list on Nasdaq in May 2025. Set to be listed with ticker symbol GLXY, its public listing will also impact the operations of its venture capital arm, Galaxy Ventures.

The Winklevosses Are Backing A 22-Year-Old Using AI To Prevent Crypto Hacks

Giovanni Vignone dropped out of Duke to tackle crypto's billion-dollar security problem. Now Gemini's billionaire founders are betting on his AI cybersecurity startup Octane.

Nigerian Court Adjourns Binance's $81.5B Tax Evasion Case to April 30

Binance's tax evasion trial in Nigeria has been adjourned until April 30. Nigeria seeks $2B in back taxes and $79.5B in damages.

US DOJ Disbands Crypto Crackdown Unit Amid Trump's Pro-Crypto Overhaul

The US Department of Justice (DOJ) has abruptly shut down its National Cryptocurrency Enforcement Team (NCET). This ends a key pillar of federal crypto oversight established under the Biden administration.